This calculation yields the weighted average value per unit—a determine that can then be used to assign a cost to both ending stock and the cost of items bought. There had been 5 books available for sale for the year 2024 and the value of the goods obtainable was $440. The weighted common cost of the books is $88 ($440 of cost of products out there ÷ 5 books). The average value of $88 is used to compute both the value of goods bought and the value of the ending stock. If the bookstore offered the textbook for $110, its gross revenue utilizing periodic LIFO will be $20 ($110 – $90).

Ship Me Accounting For Everybody Weekly Updates

Similarly, for LIFO and FIFO methods, these software program solutions can routinely keep monitor of the order by which objects have been bought or bought, ensuring accurate value reporting. By using software for inventory valuation, businesses can obtain greater accuracy, save time, and focus extra on strategic decision-making. No, the LIFO stock method just isn’t permitted underneath worldwide financial reporting standards (IFRS).

Description Of Journal Entries For Stock Gross Sales, Perpetual, First-in, First-out (fifo)

Throughout the year 2024, the writer elevated the worth of the books because of a paper shortage. The following chart reveals Corner Bookstore’s complete price of the five books was $440. This count reveals the amount of things left, which is then valued using the chosen price circulate assumption (FIFO, LIFO, or common cost) to determine the monetary value of the ending stock. Using FIFO doesn’t necessarily mean that each one the oldest inventory has been offered first—rather, it’s used as an assumption for calculation purposes.

Major Differences—lifo And Fifo (during Inflationary Periods)

This may be significantly beneficial in industries where costs are highly unstable, because it mitigates the impression of sudden price modifications on financial statements. Last-In, First-Out (LIFO) contrasts with FIFO by assuming the most just lately acquired objects are sold first. This technique can scale back taxable earnings throughout inflationary durations because it matches current greater costs towards current revenues. Nonetheless, LIFO could not replicate the actual physical circulate of inventory and can lead to outdated inventory values on the stability sheet. Recall that the order by which costs are faraway from inventory (and reported on the revenue assertion as the worth of goods sold) can be completely different from the order in which the goods are bodily faraway from inventory.

First-In, First-Out (FIFO) is a listing valuation technique that assumes the oldest inventory objects are bought first. Underneath FIFO, the worth of items offered (COGS) is based on the value of the earliest purchased objects, while the remaining inventory is valued at the worth of the newest purchases. This technique aligns intently with the precise bodily flow of stock for lots of companies, significantly those dealing with perishable goods. One of the main advantages of using the weighted average cost method is its simplicity and ease of utility. It smooths out value fluctuations over the accounting period, offering a more steady cost foundation for stock.

This technique smooths out worth fluctuations and supplies a balanced strategy to inventory valuation, neither favoring the oldest nor the most recent stock. The Last-In, First-Out (LIFO) method is a listing valuation method where essentially the most lately acquired gadgets are thought-about offered first. This methodology is especially helpful in times of rising costs, as it matches probably the most current prices with current revenues, probably decreasing taxable income. LIFO may end up in lower internet revenue compared to different strategies like FIFO (First-In, First-Out) because it assumes higher costs for the products bought.

With this accounting method, the prices of the oldest products will be reported as stock. It should be periodic lifo fifo average understood that, although LIFO matches the newest prices with sales on the earnings assertion, the circulate of costs doesn’t essentially have to match the move of the physical items. One of the principle monetary statements (along with the statement of comprehensive income, steadiness sheet, statement of cash flows, and statement of stockholders’ equity).

LIFO stands for “final in, first out,” where newer inventory is sold before older stock. A value flow assumption the place the primary (oldest) prices are assumed to circulate out first. When using the perpetual inventory system, the Inventory account is constantly (or perpetually) changing. In abstract, using the LIFO method, the value of goods bought is \$29,a hundred and eighty, and the ending stock is valued at \$16,000. Understanding these calculations is important for efficient stock management and monetary analysis. It is the amount by which a company’s taxable income has been deferred by using the LIFO technique.

- To calculate the Cost of Goods Sold (COGS) utilizing the LIFO methodology, determine the worth of your most up-to-date inventory.

- For In Type Fashion, contemplating under the LIFO method, the latest stock acquisitions are thought-about offered first, then the items that remain underneath LIFO are those who were bought first.

- Once these items have been offered, there remained 35 more models of beginning stock.

- The amount an organization pays for uncooked materials, labor, and overhead prices is continually altering.

Whereas U.S. typically accepted accounting ideas permit each the LIFO and FIFO stock method, the LIFO methodology just isn’t permitted in countries that use the International Monetary Reporting Standards (IFRS). The quantity a company pays for raw supplies, labor, and overhead prices is frequently changing. For this reason, the amount it prices to make or purchase a good today could be totally different than one week in the past.

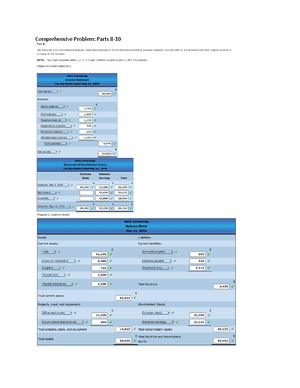

We will illustrate the FIFO, LIFO, and weighted-average price flows along with https://www.personal-accounting.org/ the periodic and perpetual stock methods. This might be carried out with easy, easy-to-understand, instructive examples involving a hypothetical retailer Nook Bookstore. In stock administration, understanding the Last In, First Out (LIFO) methodology is essential for accurately calculating the price of items offered (COGS) and ending inventory.