After the eight-week period following disbursement of a PPP loan, debtors can apply for loan forgiveness with their lenders. Don’t hesitate to leave a remark below when you have different payroll considerations. I’m at all times ready to help and make sure this is taken care of for you. We are nearing the end of the yr and we want to get this paid out beneath payroll.

Choose A Country

Find the payroll item you created and select the payroll expense account you created in step 2. Beneath deductions, choose add new, then healthcare. Use any of the medical/vision/dental choices (these are the only https://www.quickbooks-payroll.org/ non-retirement accounts that allow this).

- The bad news is, determining who qualifies as a FTE is tougher — and the only way to determine whether you’re thought-about an ALE.

- I will personally submit suggestions to them in hopes of getting an replace or an estimated time on when the feature will be added.

- Therefore, creating a liability account is step one you may wish to arrange.

- By clicking “Proceed”, you’ll go away the Neighborhood and be taken to that site instead.

- I’m all the time prepared to help and ensure this is taken care of for you.

Underneath this provision, eligible employees could obtain an extra $600 per week, on prime of the quantity they’re entitled to under state law. The further amount is meant to supplement the worker’s unemployment paycheck, which normally equates to 40-45% of their regular pay. Presently, this profit is on the market until July 31, 2020. The CARES Act also includes provisions that expand and lengthen unemployment advantages to employees who wouldn’t have been eligible to apply. Now-eligible employees embrace self-employed staff, impartial contractors, and freelancers or “gig” workers.

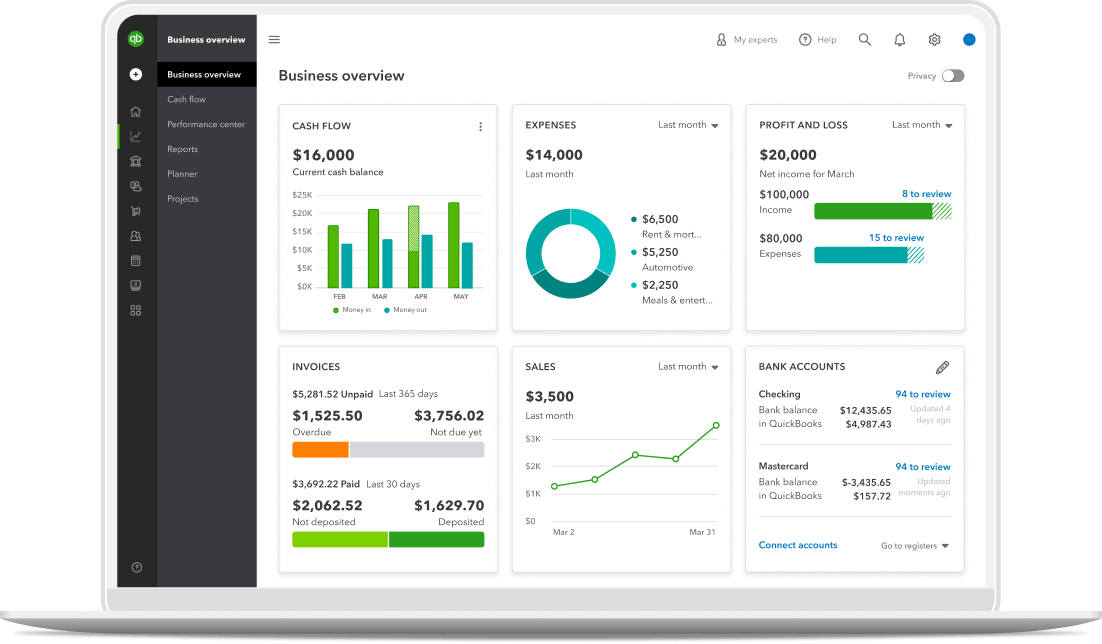

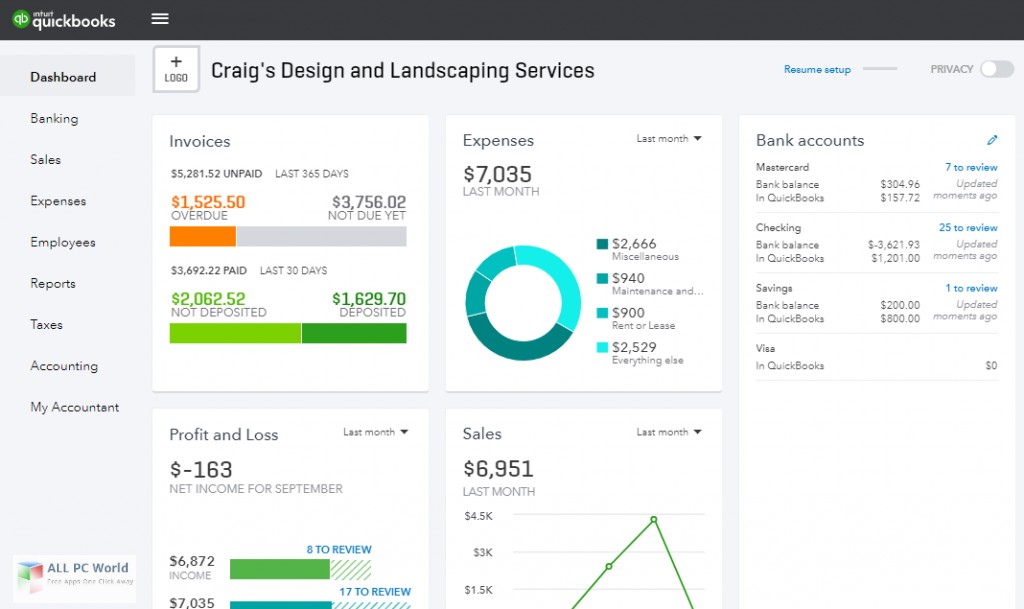

In the meantime, you can take a glance at our blog web page for any new updates to QuickBooks On-line. These credit shall be supplied to some qualifying individuals and small businesses that purchase medical insurance utilizing the Medical Well Being Insurance Marketplaces, to assist quickbooks cares act mitigate the worth of premiums and copays. The credit score can be utilized over the course of the 12 months, or when taxes are filed.

If you aren’t utilizing assisted payroll, then your experience may be totally different. I have a “WA – Cares Fund” merchandise in my “Payroll Merchandise” list (from the “Lists” menu). This was arrange last time (more than a 12 months ago) when the WA Cares fund was first launched and Intuit added that in my QB. You can change it to “0.58%” by double clicking on it to bring up the “Edit payroll item” window, simply navigate it to the third window, you will note the option to alter the percentage. There are two choices there – “0.0%” and “zero.58%”.

Find the payroll item you created and select the payroll liability account you created in step 1.10. As of now, our product engineers are still all hands on deck in implementing all of the CARES updates both in QuickBooks Desktop and the On-line versions. Economic Damage Catastrophe Loans may help businesses, renters, and homeowners affected by declared disasters. Under the EIDL provisions of the CARES Act, small business and other eligible applicants can apply for working capital loans up to $2 million. Debtors can use loans to pay fastened money owed, cowl payroll costs, and pay other bills they cannot otherwise pay as a result of financial impact of the coronavirus. For single-employer plans, any minimum employer contributions that might be due through the calendar year 2020 are due January 1, 2021.

Are Small Business House Owners Eligible For Unemployment Advantages Underneath The Cares Act?

To fix this, let’s obtain the newest payroll tax desk replace (22206). Before doing so, I’d also advocate ensuring your QBDT software is up to date to the newest release. This way, we will assure this system is working with the newest fixes and patches.

ACA Reporter additionally automatically generates lists of employees requiring coverage provides together with audit trails displaying actual calculation details. Come tax season, exporting populated Kind 1095-Cs to file with the IRS takes only a few clicks. Integrating ACA Reporter into your QuickBooks Desktop payroll system is seamless. As Soon As put in, the plug-in allows you to easily export custom payroll reports containing all required worker data for ACA calculations. Minnesota’s minimum-wage rate might be adjusted for inflation on Jan. 1, 2025, to $11.13 an hour for all employers in the state. Throughout the 2024 legislative session, Minnesota’s minimal wage legislation was…

In 2015, charges were relevant to employers with 100+ staff who had been insuring lower than 70 percent of staff. At this point, you’ll be required to pay a monthly Employer Shared Accountability Payment. (Note that penalties are calculated based on full-time staff solely, not FTEs).

Since you are seeing no differences between your profiles for workers who did get their WA Cares deducted and did not, I Might advocate getting in contact with our Customer Care team. Enterprise homeowners can even apply for an EIDL emergency advance of up to $10,000. These funds shall be made obtainable within days of software and will not need to be repaid, even if the business’ software for an EIDL mortgage is denied. Entry Intuit instruments, a personalized business feed, and a team of Reside experts and AI agents—all from one intuitive dashboard.

Determining Staff Who Require Penalty Funds

If employees are supplied reasonably priced protection (that meets minimum value necessities, see below) they aren’t eligible for a premium tax credit score. When determining the amount of charges, either precise hours of service (also referred to as the Month-to-month Measurement Method) or the Lookback Method can be used. Our product engineers are working diligently to get all of the CARES Act updates included in QuickBooks. For now, we’re unable to enter the tax-free contribution to worker’s student loans. Rest assured that I Am Going To relay this message to our group in concern here on my end.